When managing a business, understanding the financial dynamics is crucial to ensuring its sustainability and growth. One of the essential aspects of financial management is calculating cash flow to creditors. But how to calculate cash flow to creditors?

This process helps determine how much cash is being paid out to the creditors of the company, providing insight into the company’s financial health and its ability to meet debt obligations.

This article delves deep into how to calculate cash flow to creditors, explaining its significance and the various components involved.

What is Cash Flow to Creditors?

Cash flow to creditors, also known as cash flow to debt holders, refers to the net cash outflows that a company pays to its creditors over a specific period. This includes interest payments, debt repayments, and dividends paid to creditors. Understanding this cash flow is vital for assessing a company’s financial stability and its ability to manage debt effectively.

Key Components of Cash Flow to Creditors

To calculate cash flow to creditors, it’s essential to understand the key components involved:

- Interest Paid: This represents the total interest expenses incurred by the company on its outstanding debt.

- Dividends Paid: These are payments made to shareholders, which can also include debt holders.

- Debt Repayments: This includes both principal repayments and any additional debt obligations settled during the period.

Steps to Calculate Cash Flow to Creditors

- Identify Beginning Long Term Debt: This is the total amount of long-term debt that the company had at the beginning of the period.

- Determine Ending Long Term Debt: This is the total amount of long-term debt at the end of the period.

- Calculate Interest Paid: This is usually found on the income statement under interest expenses.

- Account for Dividends Paid: This can be found in the financing activities section of the cash flow statement.

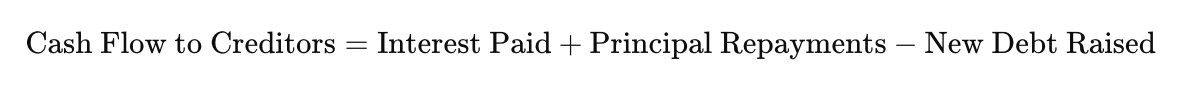

The formula for calculating cash flow to creditors is:

Detailed Explanation of Components

Interest Paid

Interest payments are the costs incurred from borrowing money. They reflect the price paid for using creditors’ funds and are a crucial part of calculating cash flow to creditors.

Higher interest expenses can indicate significant debt levels, which might raise concerns about the company’s financial health.

Dividends Paid

Dividends are payments made to shareholders from the company’s profits. While primarily associated with equity holders, some debt instruments may have provisions for dividends, making it a relevant component in this context.

Debt Repayments

This includes repayments of the principal amount of debt. It signifies the company’s efforts in reducing its debt obligations, contributing to a positive cash flow scenario. Consistent debt repayments indicate sound debt management and financial stability.

Importance of Calculating Cash Flow to Creditors

Calculating cash flow to creditors is essential for several reasons:

- Assessing Financial Health: It provides insight into the company’s ability to meet its debt obligations, crucial for maintaining financial stability.

- Debt Management: Understanding cash flow to creditors helps in managing debt effectively, ensuring that the company doesn’t overextend its financial commitments.

- Investment Decisions: For investors and creditors, this metric is vital in evaluating the company’s risk profile and its capability to generate enough cash to service debt.

Analyzing Cash Flow Statements

A cash flow statement is a financial document that provides a summary of the cash inflows and outflows over a specific period. It is divided into three sections:

- Operating Cash Flow: Cash generated from the company’s core business operations.

- Investing Activities: Cash used for investing in fixed assets and growth initiatives.

- Financing Activities: Cash flows related to borrowing and repaying debt, issuing equity, and paying dividends.

Understanding the Cash Flow Statement

A comprehensive analysis of the cash flow statement helps in understanding how well a company manages its cash inflows and outflows.

A positive cash flow indicates that the company generates more cash than it spends, which is a sign of good financial health.

Importance of Positive Cash Flow

Positive cash flow is critical for a company’s financial well-being. It ensures that the company has enough cash to meet its operational needs, invest in growth opportunities, and service its debt obligations.

A high cash flow signifies robust business operations and financial stability.

Managing Negative Cash Flow

Negative cash flow, on the other hand, can be a warning sign of potential financial trouble. It indicates that the company is spending more cash than it generates, which can lead to liquidity issues and difficulty in meeting debt obligations.

Effective debt management and strategic financial planning are essential to address negative cash flow situations.

The Role of Debt Management

Debt management involves planning and executing strategies to handle the company’s debt obligations effectively. It includes:

- Monitoring Interest Rates: Keeping an eye on interest rates to manage interest expenses and plan debt repayments efficiently.

- Balancing Debt to Equity Ratio: Maintaining a healthy balance between debt and equity to ensure financial stability.

- Timely Debt Repayments: Ensuring that debt obligations are met on time to avoid financial penalties and maintain a good credit rating.

Myth Busting: Common Misconceptions about Cash Flow to Creditors

Understanding cash flow to creditors is crucial for maintaining a company’s financial health. However, several myths can cloud the understanding of this concept.

Here, we bust five common myths and provide factual explanations to enhance your comprehension of cash flow and debt management.

Myth 1: Net Cash Flow Always Indicates Financial Health

Reality: While net cash flow is a crucial indicator of financial health, it’s not the only metric to consider. Positive net cash flow means a company has more cash inflows than outflows, but it doesn’t necessarily indicate financial stability if significant cash inflow results from borrowing money.

To get a clearer picture of a company’s financial health, one must look at the total cash flow and the sources of cash inflows and outflows, as well as how effectively the company is managing its debt repayments and interest expenses.

Myth 2: All Cash Flows are Equal

Reality: Cash inflows and outflows are not created equal. Operating cash flow, which is generated from the company’s core business operations, is more sustainable than cash inflows from financing activities, such as borrowing money.

Understanding the different sources of cash flows, including free cash flow and unlevered free cash flow, helps in analyzing a company’s true financial performance.

Free cash flow indicates the cash available after capital expenditures, while unlevered free cash flow excludes interest payments, providing insight into the company’s ability to generate cash independent of its debt structure.

Myth 3: High Dividend Payments Always Reflect Strong Performance

Reality: While high dividend payments might suggest a company is performing well, they can also be misleading.

Companies sometimes pay high dividends to maintain shareholder satisfaction even when their financial performance is not strong.

This can lead to cash outflow issues if the company does not have enough cash reserves. It’s essential to examine the company’s capital structure and retained earnings to understand if dividend payments are sustainable in the long run.

Myth 4: Debt Repayment Only Affects the Balance Sheet

Reality: Debt repayment impacts more than just the balance sheet. It affects the company’s cash flow statement and its ability to generate cash for other operations.

Significant debt repayments can strain a company’s liquidity, especially if it leads to a negative net flow.

Analyzing financial statements, including the balance sheet and cash flow statement, helps in understanding how debt repayments influence overall financial stability and the company’s ability to meet other financial commitments.

Myth 5: Most Companies Can Easily Manage Their Debt

Reality: The ability to manage debt varies widely among companies. While some businesses have robust financial structures and can handle high levels of debt, others may struggle.

Debt management is influenced by factors such as the company’s capital structure, the total interest paid on outstanding debt, and its ability to generate consistent cash inflows.

Companies that face challenges in servicing debt often have a higher risk of financial instability, underscoring the importance of prudent debt management and realistic financial planning.

Dr. Emily Hartman, Chief Financial Analyst at Global Business Insights on Company’s Financial Health:

“Understanding the correct application of the creditors formula is crucial for any company aiming to maintain financial stability.

When a company takes on debt, it’s not just about borrowing funds but also about having a clear strategy for how that debt will be repaid.

Misunderstanding the creditors definition or misapplying the formula can lead to significant challenges, especially when a company struggles with cash flow.

It’s vital to regularly reassess capital structures to ensure they align with the company’s long-term financial goals, thereby preventing any potential financial distress and debt repaid.”

Common Mistakes: Operating Cash Flow to Creditors

When managing cash flow to creditors, several common errors can lead to financial missteps and misunderstandings.

Below, we outline five typical mistakes, explain why they occur, and provide guidance on how to avoid them, helping you strengthen your company’s financial management.

Misinterpreting Non-Cash Expenses

One frequent mistake is misinterpreting non-cash expenses like depreciation and amortization, which appear on the income statement but do not involve actual cash outflows. These items reduce net income, leading some to believe there’s less cash available than there truly is.

To avoid this, always differentiate between non-cash expenses and real cash outflows. Focus on cash flow from operations, which adjusts for these non-cash items, to get an accurate picture of your company’s cash position.

Overestimating the Ability to Borrow Money

Many companies mistakenly assume they can easily borrow money to cover cash flow shortfalls without fully considering the long-term impact on financial stability.

This overconfidence can lead to over-leveraging, where the business takes on more debt than it can handle.

It’s crucial to carefully assess your capital structure and existing debt obligations before taking on additional debt. Ensure that any borrowing aligns with your overall financial strategy and that there’s a solid plan for repayment.

Misunderstanding the Calculation of Cash Flow to Creditors

The calculation of cash flow to creditors can be complex, leading to errors if not handled carefully. Some might mistakenly include irrelevant items or overlook critical components like repaid debt or interest payments.

To prevent this, make sure you thoroughly understand the calculation process and regularly review your financial statements to ensure all cash flows related to creditors are accurately reflected.

Failing to Secure Sufficient Cash for Debt Obligations

Another common mistake is failing to ensure there’s enough money available to meet debt obligations, often due to inadequate cash flow planning.

Companies sometimes rely too heavily on anticipated cash inflows without accounting for potential delays or shortfalls, which can lead to serious financial difficulties.

To avoid this, develop a robust cash flow forecast that includes conservative estimates and maintains a sufficient cash reserve to cover debt, even during challenging periods.

Ignoring Early Warning Signs of Financial Trouble

Lastly, some companies overlook early signs of financial distress, such as persistent cash flow shortages or rising debt levels. Ignoring these indicators can lead to severe financial difficulties, making recovery challenging.

It’s essential to regularly monitor key financial metrics, including cash flow, debt levels, and your overall capital structure. If your company shows signs of struggling, take proactive steps to address the issues, such as restructuring debt or adjusting your financial strategy.

Conclusion on How to Calculate Cash Flow to Creditors

Understanding and calculating cash flow quadrant to creditors is crucial for any business owner or financial manager. It provides a clear picture of the company’s financial health, debt management capabilities, and overall financial stability. By closely monitoring cash flows and implementing effective debt management strategies, businesses can ensure sustainable growth and meet their financial commitments efficiently.

For any company, maintaining a positive cash flow, managing debt effectively, and ensuring timely debt repayments are key to achieving long-term financial success. By following these guidelines, businesses can enhance their financial well-being and build a strong foundation for future growth.