Cash is the lifeblood of your business. That’s why it’s so important to monitor your company’s cashflow.

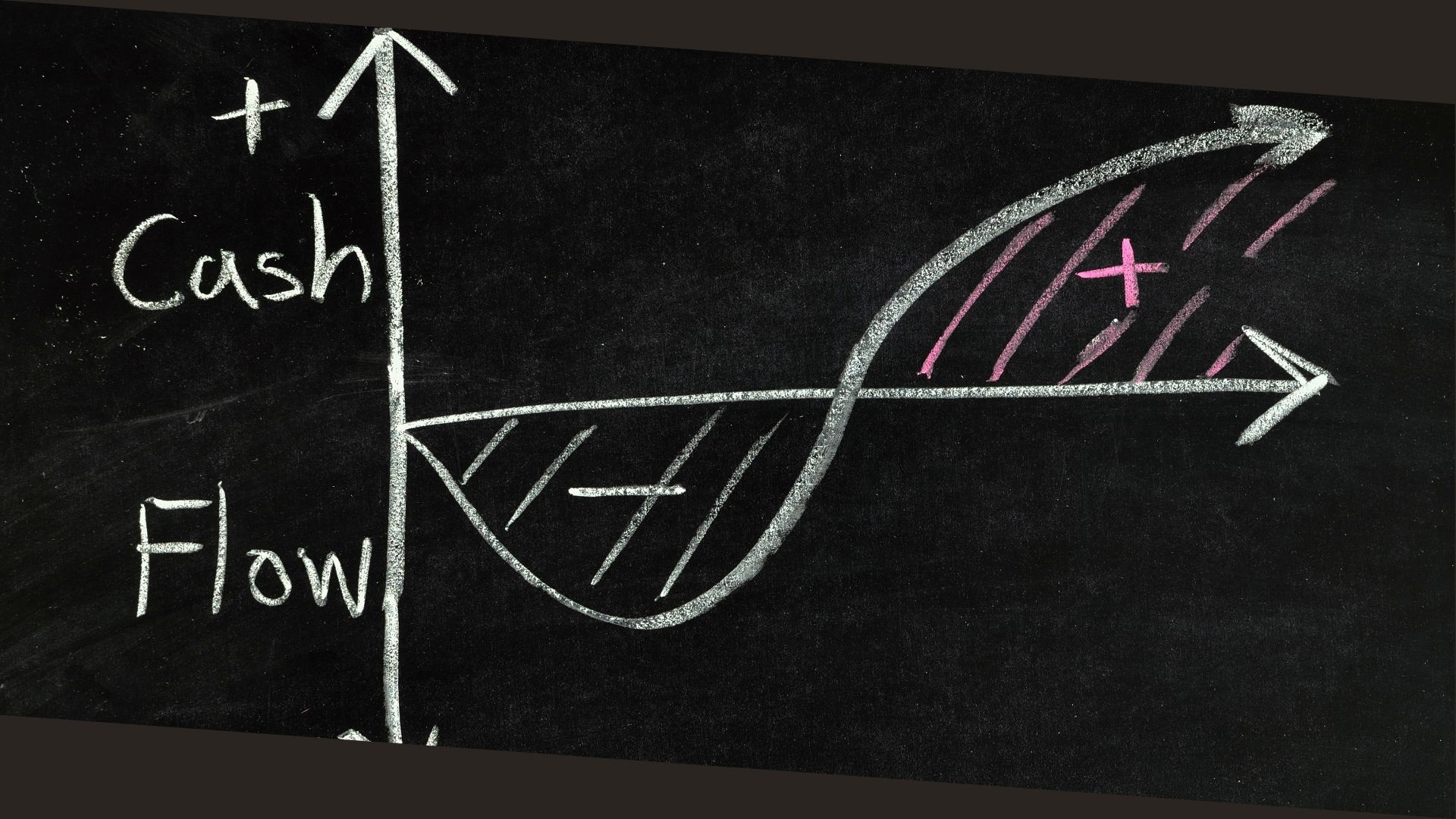

Cash flow is the amount of money coming in and going out of your business. This includes revenue and expenses.

If you have more money coming in than going out, you have a positive cash flow. If you have more money going out than coming in, you have a negative cash flow.

Positive cash flow is important because it enables you to pay your bills and invest in growth. Negative cash flow, on the other hand, can be a sign of trouble because it often means you’re spending more money than you’re making.

In fact, negative cash flow is one of the main reasons businesses fail. According to a U.S. Bank study, 82% of businesses that fail do so because of cash flow problems.

The good news is that you can prevent cash flow problems from happening in your business. You just need to keep a close eye on your company’s cash flow by monitoring it regularly.

1. Use a cash flow statement

The cash flow statement is one of the key financial statements of your business. It shows how changes in your balance sheet and income statements affect cash and cash equivalents.

The cash flow statement is divided into three parts: operating activities, investing activities, and financing activities. The statement of cash flows is a good way to see how the money comes into and out of your business and how it affects your cash position.

2. Create a budget

Creating a budget is one of the most important things you can do as a business owner. A budget helps you plan for the future and make sure you have enough cash on hand to cover your expenses. For businesses that rely on digital tools, integrating cost-effective solutions, like the best Wix affiliate apps, can help you enhance your income stream while managing expenses.

When you create a budget, you’ll list all of your expected income and expenses for the month. Then you can compare your actual income and expenses to your budget each month to see how you’re doing.

If you’re consistently spending more than you’re making, you’ll need to take a look at where you can cut expenses or increase revenue. A budget can help you make sure you’re not spending money you don’t have.

3. Monitor your gross profit margin

Your gross profit margin is an important measure of how much money you’re making before you start to pay your overheads.

To calculate it, you simply subtract the cost of the goods you sell from your sales revenue, then divide the result by your sales revenue and multiply by 100 to get a percentage.

You should monitor your gross profit margin on a regular basis to make sure it’s consistent with industry standards. If your gross profit margin is too low, you may need to increase your prices or find ways to reduce your costs.

4. Set up a cash reserve

A cash reserve is a sum of money that you set aside to help you deal with any unexpected cash flow problems. If you have a cash reserve, you won’t need to borrow money or use your overdraft to cover any short-term shortfalls. This approach is particularly beneficial for small ventures, such as a lemonade business, where fluctuating cash flows can significantly impact operations.

A good rule of thumb is to have a cash reserve that would cover at least three months’ worth of your fixed costs. But the amount you need to set aside will depend on the size and nature of your business.

5. Review your payment terms

Do you have standard payment terms with your suppliers and customers? If not, it might be time to introduce some.

If you have existing terms, are they being adhered to? If not, why not? Regularly reviewing your payment terms will ensure you are being paid on time and not paying your suppliers too soon.

This is a simple way to improve your cash flow without doing anything else.

6. Set up a cashflow forecast

A cashflow forecast is one of the most important tools in business. It helps you to predict your future income and outgoings, and can be used to identify any potential cashflow problems.

There are many different ways to set up a cashflow forecast, but one of the most common is to use a simple spreadsheet. You can then update the forecast on a regular basis to reflect any changes in your business.

A good cashflow forecast will help you to identify any potential cashflow problems before they arise, and will also help you to plan for the future.

7. Track your cashflow regularly

Cashflow is a key indicator of your business’s financial health, so it’s important to track it regularly.

This will help you identify any potential problems early on, so you can take steps to address them before they become more serious.

It will also help you to identify any opportunities to improve your cashflow, and to take advantage of them.

8. Reduce costs

If you see that your business is running out of cash, then the most obvious thing to do is to look at how you can reduce your costs.

This could be by cutting out non-essential spending, or by looking at ways you could reduce your costs by getting better deals from suppliers, or by improving the efficiency of your business.

9. Increase prices

This is the most obvious way to increase your revenue but is one that is often overlooked.

If your costs are increasing but you are not increasing your prices then you are making less profit.

If you have a product or service that is in demand then increasing your prices could increase your profits and cashflow.

It is always worth testing the market to see if you can increase your prices. If you put your prices up and no one complains then you probably could have done it sooner.

10. Chase up overdue invoices

No one likes to feel like they are pestering their customers, but when your cash flow is suffering due to overdue invoices you need to take action.

It’s important to have a set process for chasing up overdue invoices, and to make sure that you follow it consistently.

This will help to keep your relationship with your customers on good terms, while also ensuring that you get paid on time.

11. Get professional advice

There are many ways to monitor cash flow and many things to consider. If you want to be sure you are doing what you need to do to monitor cash flow effectively, seek professional advice.

Cash flow is the lifeblood of your business. You should be doing everything you can to make sure you are managing your cash flow effectively.

12. Consider a business loan

If you are facing a cash crunch, then one way to solve this short-term problem is to get a business loan. There are many types of business loans, and the right one for your company will depend on your specific situation.

For example, if you have a lot of unpaid invoices, then you might consider a factoring loan. This type of loan allows you to get an advance on your unpaid invoices, which can help you get the cash you need right away.

Alternatively, you might consider a line of credit. A line of credit is a type of loan that allows you to borrow money up to a certain limit. You can use the money as needed, and you only have to pay interest on the amount you borrow. This can be a good option if you need a short-term cash infusion, but you’re not sure exactly how much you will need.

If you’re not sure what type of loan is right for your business, then you should talk to a financial advisor. They can help you evaluate your options and find the best loan for your specific situation.

Conclusion

Your cashflow is the lifeblood of your business. If you are not managing it, you are putting your business at risk. Cashflow is the number one reason businesses fail. Don’t let it happen to you. Use the tips, tools, and advice in this article to manage your cashflow proactively and successfully.