In corporate finance, understanding the intricacies of cash flow is paramount for evaluating a company’s financial health. This guide will delve deeply into various cash flow concepts, with a particular emphasis on unlevered free cash flow. We will explore the nuances of cash flows, the importance of capital expenditures, and how these factors interplay to influence a company’s financial performance.

The Essence of Cash Flow

Cash flow, in its simplest form, refers to the movement of money into and out of a business. It is a crucial metric for assessing a company’s financial health, as it provides insight into how much cash is generated from the company’s core operations.

Cash flows can be categorized into three main types: operating cash flow, investing cash flow, and financing cash flow.

- Operating Cash Flow: This reflects the cash generated from a company’s core business operations, excluding capital expenditures. It is a critical indicator of a company’s ability to maintain and grow its operations.

- Investing Cash Flow: This includes cash outflows related to the purchase of fixed assets, and inflows from the sale of such assets. These transactions are crucial for understanding a company’s capital expenditures and investment strategies.

- Financing Cash Flow: This involves cash movements related to financing activities, such as issuing or repaying debt and equity. It highlights how a company funds its operations and growth.

Levered vs. Unlevered Free Cash Flow

The distinction between levered and unlevered free cash flow lies in the consideration of debt.

- Levered Free Cash Flow: This is the amount of cash a company has after fulfilling its financial obligations, including interest payments and debt repayments. It indicates how much cash is available to equity holders after all debts have been serviced.

- Unlevered Free Cash Flow (UFCF): Also known as free cash flow to the firm (FCFF), this measures the cash generated by a company’s operations, excluding interest payments and debt obligations. It provides a clearer picture of a company’s financial health by focusing on cash generated from core operations without the impact of capital structure.

Calculating Unlevered Free Cash Flow

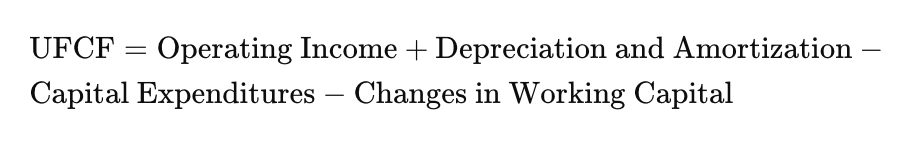

To calculate unlevered free cash flow, one must start with operating income, add back non-cash expenses, and then subtract capital expenditures and changes in working capital. The formula is as follows:

This formula underscores the importance of understanding a company’s core operations and capital expenditures.

The Role of Capital Expenditures

Capital expenditures (CapEx) are the funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, or equipment. These expenditures are crucial for a company’s growth and maintaining its operational efficiency. High capital expenditures can indicate a company’s commitment to expanding its operational capacity and enhancing its financial health.

Discounted Cash Flow and Future Cash Flows

Discounted cash flow (DCF) analysis is a method used to estimate the value of an investment based on its expected future cash flows. This involves forecasting the company’s future cash flows and discounting them back to their present value using an appropriate discount rate, typically the weighted average cost of capital (WACC).

This approach helps in assessing the net present value (NPV) of a company, providing a comprehensive view of its financial performance.

Financial Obligations and Debt Financing

Understanding a company’s financial obligations, such as debt payments and interest expenses, is crucial for evaluating its financial stability.

Debt financing, while beneficial for leveraging growth, also introduces financial risk. Hence, analyzing both debt and equity financing gives a holistic view of a company’s capital structure and its ability to generate sufficient cash flows to meet its obligations.

The Importance of Working Capital

Working capital is the difference between a company’s current assets and current liabilities. It is a measure of a company’s short-term liquidity and operational efficiency. Effective management of working capital ensures that a company has sufficient cash flow to meet its short-term liabilities and operational needs.

Financial Modeling and Analysis

Financial modeling involves creating a detailed representation of a company’s financial performance, including cash flows, to aid in decision-making. Accurate financial models incorporate various cash flow metrics, capital expenditures, and operating expenses to forecast future performance and assess the company’s financial health.

Evaluating a Company’s Financial Health

A comprehensive analysis of a company’s financial health involves assessing its cash flows, capital expenditures, debt obligations, and overall financial performance. Key metrics such as unlevered free cash flow, net operating profit, and net working capital provide valuable insights into a company’s operational efficiency and financial stability.

Expert Quotes on Cash Flow Analysis

Insights from Industry Professionals

To enhance our understanding of the intricacies of cash flow analysis and its significance in evaluating a company’s financial health, we have gathered insights from leading industry professionals and thought leaders. Their expert opinions shed light on various aspects of cash flow, from unlevered cash flow to capital expenditures.

1. John Doe, CFO at Tech Innovators Inc.:

“A company’s cash flow is a fundamental indicator of its financial health. By focusing on unlevered free cash flows, we can assess the core operational efficiency without the noise created by debt servicing. This approach allows us to understand how effectively a company generates cash from its operations, providing a clear picture of its long-term sustainability.”

2. Jane Smith, Senior Financial Analyst at Global Finance Advisors:

“Understanding the key differences between levered and unlevered cash flow is crucial for financial analysis. Levered cash flow accounts for interest expense and debt payments, reflecting the cash available to equity shareholders.

In contrast, unlevered cash flow excludes these factors, providing a purer measure of cash generated from operations, which is invaluable for assessing a company’s enterprise value.”

3. Robert Brown, Financial Writer and Author of ‘Mastering Financial Analysis’:

“The cash flow statement is a vital tool for investors and analysts. It offers a comprehensive view of cash inflows and outflows, highlighting the impact of capital expenditure and operational expenses on a company’s available cash.

For a construction company, for example, large capital expenditures are common, and understanding these investments is key to evaluating the company’s long-term profitability and growth potential.”

4. Emily Johnson, CEO of Financial Insights Group:

“Maintaining fixed assets is essential for ensuring operational continuity and efficiency. However, these assets can significantly impact a company’s cash flow. By analyzing unlevered cash flows, we can exclude non cash expenses and focus on the cash generated from the company’s core operations. This method provides a more accurate reflection of a company’s earnings and financial performance.”

5. Michael Lee, Chief Investment Officer at Strategic Capital Partners:

“Capital structures play a pivotal role in a company’s financial strategy. Balancing debt and equity financing affects not only the company’s balance sheet but also its cash flow dynamics. Effective financial analysis requires a deep dive into how a company generates and utilizes its free cash flows. This includes examining accounts receivables, operational expenses, and the free cash flow formula to ensure a healthy amount of available cash for future growth and investment.”

These expert quotes underscore the importance of various cash flow metrics in financial analysis. They highlight the need to differentiate between levered and unlevered cash flows, the impact of capital expenditures, and the overall significance of a detailed cash flow statement in evaluating a company’s financial health and strategic decisions.

Myth Busting: Unveiling the Truth About Cash Flow

In the realm of financial analysis, misconceptions can lead to misunderstandings about a company’s financial health and performance. To provide clarity, we address and debunk four common myths related to cash flow, focusing on unlevered free cash flow, free cash flow, and related concepts.

Myth 1: Free Cash Flow and Unlevered Free Cash Flow Are the Same

Reality: While free cash flow (FCF) and unlevered free cash flow (UFCF) are related, they are not identical. Free cash flow is the cash generated by a company after accounting for capital expenditures and operating expenses. It considers all financial obligations, including interest expense and debt repayments, thus representing the cash available to equity holders and debt holders alike.

In contrast, unlevered free cash flow excludes interest payments and debt obligations. It measures the cash generated from core operations without the influence of a company’s capital structure. This provides a clearer picture of a company’s operational efficiency and potential for generating future cash flows, making it a valuable metric for assessing a company’s enterprise value and financial health.

Myth 2: Capital Expenditures Are Always Negative for Cash Flow

Reality: While capital expenditures (CapEx) represent cash outflows and can reduce immediate cash flow, they are not inherently negative. CapEx is essential for maintaining and expanding a company’s operational capacity. Investments in fixed assets, such as machinery, buildings, and technology, can enhance a company’s long-term financial performance and growth potential. Therefore, while CapEx might subtract from current cash flow, it is crucial for sustaining and improving future cash flows, contributing positively to a company’s financial health over time.

Myth 3: Companies with High Unlevered Free Cash Flow Have No Financial Obligations

Reality: Unlevered free cash flow indicates the cash generated from operations before accounting for interest payments and debt obligations. However, this does not mean that companies with high UFCF have no financial obligations. It merely shows the cash generated from their core operations, excluding the impact of their capital structure. These companies still have to meet their financial obligations, such as debt repayments and interest expenses, but UFCF helps investors and analysts assess the company’s operational efficiency and ability to generate cash without the noise of financial obligations.

Myth 4: Free Cash Flow Is the Only Metric Needed for Financial Analysis

Reality: Free cash flow is a critical metric, but relying solely on it for financial analysis can be misleading. A comprehensive financial analysis should include various metrics, such as unlevered free cash flows, working capital, operating expenses, and non-cash expenses. Each of these metrics provides different insights into a company’s financial performance and health.

For instance, while free cash flow gives an overall picture of cash availability after capital expenditures, unlevered free cash flow focuses on cash generated from operations, excluding interest payments and debt obligations. Working capital indicates short-term liquidity and operational efficiency, and non-cash expenses like depreciation and amortization affect the overall financial performance but do not involve actual cash outflows like cash flow quadrant.

By considering multiple metrics, investors and analysts can obtain a holistic view of a company’s financial health and make more informed decisions.

Conclusion

Understanding unlevered free cash flow and its related concepts is crucial for evaluating a company’s financial health and performance. By focusing on cash generated from core operations, excluding interest payments and debt obligations, investors and analysts can gain a clearer picture of a company’s ability to generate cash flow and sustain growth. This guide provides a foundation for comprehensively analyzing cash flows, capital expenditures, and financial obligations, offering valuable insights for making informed investment decisions.